Today in this blog we will try to know Metro Brands Share Price Target 2025, 2026, 2027, To 2030 In this blog we are going to analyze the stock Metro Brands Ltd of the Leather sector. In this blog we will do all the research of the company for you like what does the company do? How can the performance of the company be for 5 years? Future status of the company? You will find information about all this research in this blog.

After reading this blog, you will also get to know about the technical analysis along with fundamentals about Metro Brands Ltd. From which you can find out whether you should invest in this company or not, so let’s try to know the company.

About Metro Brands Ltd

Metro Brands Limited mainly manufactures and sells footwear and accessories. The company sells its products through its own stores and online platforms. The company’s products include a variety of shoes such as sneakers, sandals, formal shoes, sports shoes, etc.

Metro Brands Limited was founded in 1977. The company is headquartered in Mumbai, Maharashtra.

| Company Name | Metro Brands Ltd |

| Market Cap | ₹ 35,865 Cr. |

| P/E | 87.3 |

| ROE (Return on equity) | 24.2 % |

| ROCE (Return on Capital Employed ) | 19.7 % |

| 52 Week High (09-Aug-2024) | ₹ 1,430.00 |

| 52 Week Low (04-Jun-2024) | ₹ 990.05 |

| DIV. YIELD | 0.39 % |

| Date of Listing | 22-Dec-2021 |

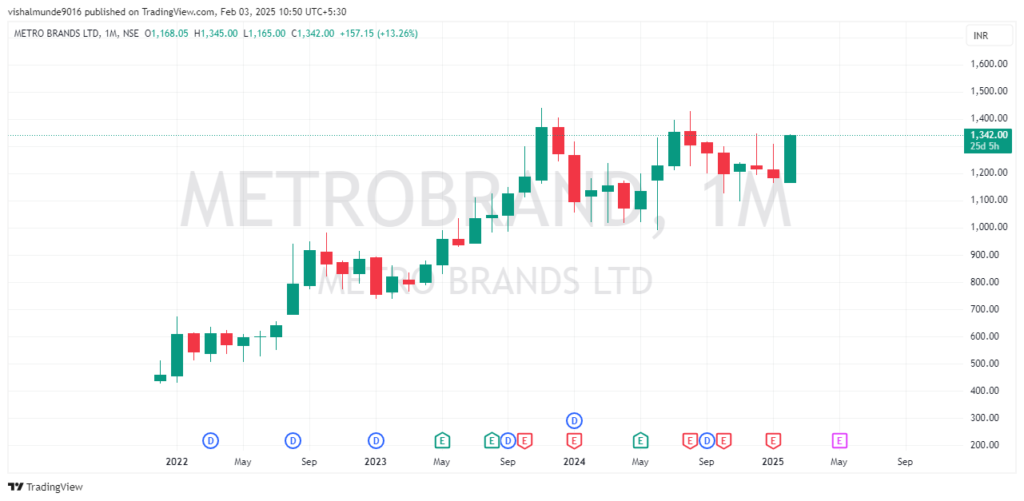

Metro Brands last 5 Year Performance

If we talk about the returns of Metro Brands Ltd (METROBRAND) share in the last few years, then the company has given 23.34% returns to its investors in the last 1 year (Feb 2024 – Feb 2025). And if we talk about 5 Year’s Returns, then it has given 182.37% returns to its investors which is good.

| 3 Month Returns | 11.46% |

| 1 Year’s Returns | 23.34% |

| 5 Year’s Returns | 182.37% |

| Sales growth 3 Years | 43.4 % |

| Sales growth 5 Years | 14.1 % |

| Return over 3years | 28.5 % |

| Return over 5years | – |

Read this also:- Finolex Industries Share Price Target 2025, 2026, 2027, To 2030 – Stock Era

Metro Brands Share Price Target 2025-2030

| Year | Target 1 | Target 2 |

| 2025 | ₹1,500 | ₹1,600 |

| 2026 | ₹1,700 | ₹1,900 |

| 2027 | ₹2,000 | ₹2,200 |

| 2028 | ₹2,400 | ₹2,600 |

| 2029 | ₹2,800 | ₹3,000 |

| 2030 | ₹3,200 | ₹3,500 |

Metro Brands Share Price Target 2025

Talking about the Metro Brands Share Price Target 2025, our analysis has said that this stock can remain between ₹ 1,500 and ₹ 1,600 in 2025.

These targets are given after looking at the data of the past history of the stock. In this, fundamental analysis has been done along with technical analysis.

| Target 1 | Target 2 |

| ₹ 1500 | ₹ 1600 |

Metro Brands Share Price Target 2026

If the demand in this industry and the sales of this company see an increase, then as per our research the share price of Metro Brands Ltd may remain between ₹ 1,700 and ₹ 1,900 by 2026.

| Target 1 | Target 2 |

| ₹ 1700 | ₹ 1900 |

Read this also:- Alkem Share Price Target 2025, 2026, 2027, To 2030 – Stock Era

Metro Brands Share Price Target 2027

These share targets have been derived by looking at the company’s past performance. If the company’s performance remains good, then according to our analysts, the target for Metro Brands shares in 2027 can be between ₹ 2,000 and ₹ 2,200.

| Target 1 | Target 2 |

| ₹ 2000 | ₹ 2200 |

Metro Brands Share Price Target 2028

By analyzing the trend and stock of the last few years, it is known that if we talk about the target of Metro Brands share price in 2028, then it can be between ₹ 2,400 and ₹ 2,600.

| Target 1 | Target 2 |

| ₹ 2400 | ₹ 2600 |

Metro Brands Share Price Target 2029

Looking at the history of the last 5 years and the fundamental analysis of the stock, it seems that in the coming years i.e. if we talk about the target of Metro Brands Share in 2029, then ₹ 2,800 and ₹3,000 can be seen.

| Target 1 | Target 2 |

| ₹ 2800 | ₹ 3000 |

Metro Brands Share Price Target 2030

The price of Metro Brands stock can remain between ₹ 3,200 to ₹ 3,500 by 2030. This price can also go up or down, this price is told by analyzing the stock data of the last 5 years.

The price of the company’s stock depends on how the company performs in the coming time. You must take the help of your financial advisor before investing.

| Target 1 | Target 2 |

| ₹ 3,200 | ₹ 3500 |

Metro Brands Promoters Holding

Friends, before investing in any company, it is very important to see the holding of the company’s promoters because from this we get an idea that if the promoters of the company have maintained their holding and are not selling it, then the company is performing well and can perform well.

It is said that it is not good if promoter’s holding is less in any company but it is said that if the holdings of FIIs and DIIs are increasing then it is good.

If we talk about the promoters’ holding in this company, it is 71.93%. You will see below who else has a stake in it.

| Mar 2022 | Mar 2023 | Mar 2024 | Dec 2024 | |

| Promoters | 74.27% | 74.20% | 74.16% | 71.93% |

| FIIs | 3.38% | 2.80% | 2.68% | 3.43% |

| DIIs | 4.58% | 5.29% | 6.02% | 7.18% |

| Public | 17.77% | 17.72% | 17.13% | 17.47% |

Metro Brands Peer Companies

- Metro Brands

- Bata India

- Relaxo Footwear

- Campus Activewe.

- Mayur Uniquoters

- Bhartiya Intl.

- Liberty Shoes

Conclusion

We hope that you have got all the information about Metro Brands Share Price Target 2025, 2026, 2027, To 2030 properly and how did you like our blog, please tell us by commenting and also tell us what are your thoughts about Metro Brands Ltd. Do share this article with your friends.

Frequently Asked Questions FAQ’S

Is there any debt on Metro Brands ?

As of today when we are posting this blog (March ,2025 ) Metro Brands has a debt of ₹ 1,117 Cr.

What does Metro Brands Ltd do?

Metro Brands Limited is one of the largest footwear and accessories retailers in India. The company sells a wide range of footwear and accessories for men, women and children.

What is the price target of Metro Brands in 2025?

Talking about the Metro Brands Share Price Target 2025, our analysis has said that this stock can remain between ₹ 1,500 and ₹ 1,600 in 2025.

What is the price target of Metro Brands in 2030?

The price of Metro Brands stock can remain between ₹ 3,200 to ₹ 3,500 by 2030. This price can also go up or down, this price is told by analyzing the stock data of the last 5 years.

Read this also:- Strides Pharma Share Price Target 2025, 2026, 2027, To 2030 – Stock Era

Disclaimer : The information presented in this article is for educational and informational purposes only. We do not recommend buying or selling stocks. These predictions are based on our research and technical data, any uncertainty in the market may affect the stock price, so investors should do their own research before making investment decisions. We will not be responsible for any loss or damage caused by the use of this article.