Today in this blog we will try to know JBM Auto Share Price Target 2025, 2026, 2027, To 2030 In this blog we are going to analyze the stock JBM Auto Ltd of the Auto Ancillaries sector. In this blog we will do all the research of the company for you like what does the company do? How can the performance of the company be for 5 years? Future status of the company? You will find information about all this research in this blog.

After reading this blog, you will also get to know about the technical analysis along with fundamentals about JBM Auto Ltd. From which you can find out whether you should invest in this company or not, so let’s try to know the company.

About JBM Auto Ltd

JBM Auto Ltd is a leading Indian automotive company engaged in the manufacturing of auto parts and assembly. The company produces parts for a wide range of vehicles, including passenger cars, commercial vehicles, and two-wheelers. Additionally, JBM Auto is also involved in the manufacturing of electric buses and other electric vehicles.

| Company Name | JBM Auto Ltd |

| Market Cap | ₹ 15,315 Cr. |

| P/E | 80.0 |

| ROE (Return on equity) | 15.9 % |

| ROCE (Return on Capital Employed ) | 14.4 % |

| 52 Week High (19-Feb-2024) | ₹ 1,214.18 |

| 52 Week Low (18-Feb-2025) | ₹ 557.00 |

| DIV. YIELD | 0.12 % |

| Date of Listing | 17-Dec-2004 |

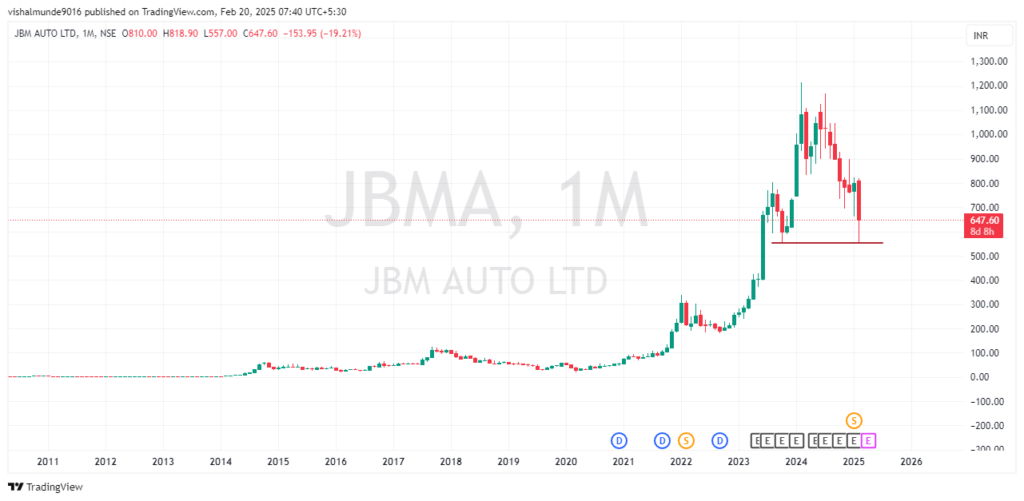

JBM Auto last 5 Year Performance

If we talk about the returns of JBM Auto Ltd share in the last few years, then the company has given -45.62% returns to its investors in the last 1 year ( Feb 2024 – Feb 2025). And if we talk about 5 Year’s Returns, then it has given 461.18% returns to its investors.

| 3 Month Returns | -10.18% |

| 1 Year’s Returns | -45.62% |

| 5 Year’s Returns | 461.18% |

| Sales growth 3 Years | 20.5 % |

| Sales growth 5 Years | 12.1 % |

| Return over 3years | 87.8 % |

| Return over 5years | 40.2 % |

Read this also:- Westlife Share Price Target 2025, 2026, 2027, To 2030 – Stock Era

JBM Auto Share Price Target 2025-2030

| Year | Target 1 | Target 2 |

| 2025 | ₹850 | ₹1000 |

| 2026 | ₹1000 | ₹1200 |

| 2027 | ₹1150 | ₹1400 |

| 2028 | ₹1300 | ₹1600 |

| 2029 | ₹1450 | ₹1800 |

| 2030 | ₹1600 | ₹2000 |

JBM Auto Share Price Target 2025

Talking about the JBM Auto Share Price Target 2025, our analysis has said that this stock can remain between ₹ 850 and ₹ 1000 in 2025.

These targets are given after looking at the data of the past history of the stock. In this, fundamental analysis has been done along with technical analysis.

| Target 1 | Target 2 |

| ₹ 850 | ₹ 1000 |

JBM Auto Share Price Target 2026

If the demand in this industry and the sales of this company see an increase, then as per our research the share price of JBM Auto Ltd may remain between ₹ 1000 and ₹ 1200 by 2026.

| Target 1 | Target 2 |

| ₹ 1000 | ₹ 1200 |

Read this also:- Metro Brands Share Price Target 2025, 2026, 2027, To 2030 – Stock Era

JBM Auto Share Price Target 2027

These share targets have been derived by looking at the company’s past performance. If the company’s performance remains good, then according to our analysts, the target for JBM Auto shares in 2027 can be between ₹ 1150 and ₹ 1400.

| Target 1 | Target 2 |

| ₹ 1150 | ₹ 1400 |

JBM Auto Share Price Target 2028

By analyzing the trend and stock of the last few years, it is known that if we talk about the target of JBM Auto share price in 2028, then it can be between ₹ 1300 and ₹ 1600.

| Target 1 | Target 2 |

| ₹ 1300 | ₹ 1600 |

JBM Auto Share Price Target 2029

Looking at the history of the last 5 years and the fundamental analysis of the stock, it seems that in the coming years i.e. if we talk about the target of JBM Auto Share in 2029, then ₹ 1450 and ₹1800 can be seen.

| Target 1 | Target 2 |

| ₹ 1450 | ₹ 1800 |

JBM Auto Share Price Target 2030

The price of JBM Auto stock can remain between ₹1600 to ₹2000 by 2030. This price can also go up or down, this price is told by analyzing the stock data of the last 5 years.

The price of the company’s stock depends on how the company performs in the coming time. You must take the help of your financial advisor before investing.

| Target 1 | Target 2 |

| ₹1600 | ₹2000 |

JBM Auto Promoters Holding

Friends, before investing in any company, it is very important to see the holding of the company’s promoters because from this we get an idea that if the promoters of the company have maintained their holding and are not selling it, then the company is performing well and can perform well.

It is said that it is not good if promoter’s holding is less in any company but it is said that if the holdings of FIIs and DIIs are increasing then it is good.

If we talk about the promoters’ holding in this company, it is 67.53% You will see below who else has a stake in it.

| Mar 2023 | Mar 2024 | Dec 2024 | |

| Promoters | 67.53% | 67.53% | 67.53% |

| FIIs | 1.66% | 3.34% | 3.28% |

| DIIs | 0.05% | 0.06% | 0.07% |

| Public | 30.76% | 29.09% | 29.12% |

JBM Auto Peer Companies

- Sona BLW Precis.

- Exide Inds.

- Endurance Tech.

- Motherson Wiring

- JBM Auto

Conclusion

We hope that you have got all the information about JBM Auto Share Price Target 2025, 2026, 2027, To 2030 properly and how did you like our blog, please tell us by commenting and also tell us what are your thoughts about JBM Auto Ltd. Do share this article with your friends.

Frequently Asked Questions FAQ’S

Is there any debt on JBM Auto ?

As of today when we are posting this blog, JBM Auto has a debt of ₹ 2,636 Cr.

What does JBM Auto Ltd do?

JBM Auto Ltd is a leading Indian automotive company engaged in the manufacturing of auto parts and assembly.

What is the price target of JBM Auto in 2025?

Talking about the JBM Auto Share Price Target 2025, our analysis has said that this stock can remain between ₹ 850 and ₹ 1000 in 2025.

What is the price target of JBM Auto in 2026?

If the demand in this industry and the sales of this company see an increase, then as per our research the share price of JBM Auto Ltd may remain between ₹ 1000 and ₹ 1200 by 2026.

What is the price target of JBM Auto in 2030?

The price of JBM Auto stock can remain between ₹1600 to ₹2000 by 2030. This price can also go up or down, this price is told by analyzing the stock data of the last 5 years.

Read this also:- Jupiter Wagons Share Price Target 2025, 2026, 2027, To 2030 – Stock Era

Disclaimer : The information presented in this article is for educational and informational purposes only. We do not recommend buying or selling stocks. These predictions are based on our research and technical data, any uncertainty in the market may affect the stock price, so investors should do their own research before making investment decisions. We will not be responsible for any loss or damage caused by the use of this article.